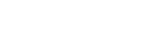

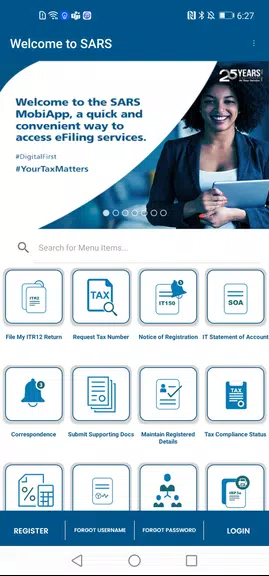

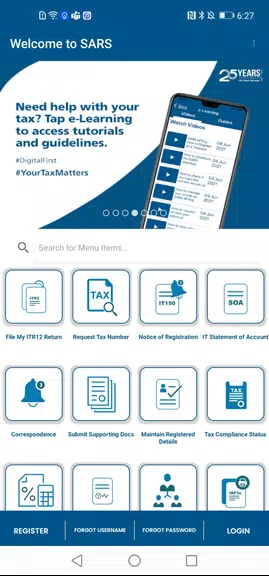

The SARS Mobile eFiling App is revolutionizing the way taxpayers in South Africa manage their Income Tax Returns. Designed with convenience and efficiency in mind, this powerful tool allows users to complete, save, edit, and submit their annual tax returns directly from their smartphones, tablets, or iPads. Whether you're at home, on the move, or simply prefer managing your taxes outside of office hours, the app puts everything you need right at your fingertips. With features like the built-in tax calculator to estimate your refund or balance due, and real-time tracking of your return status post-submission, the SARS Mobile eFiling App simplifies the entire process—making tax season less stressful and more manageable.

Key Features of the SARS Mobile eFiling App

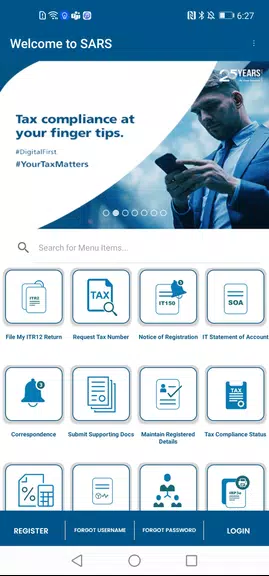

- On-the-Go Filing: Complete and submit your personal Income Tax Return anytime, anywhere using your mobile device. No need to wait until you're at your desktop.

- Local Save & Edit: Start your return, save it locally on your device, and come back to it later. Perfect for those who want to gather documents gradually or double-check figures before submitting.

- Tax Calculator: Use the integrated tax calculator to estimate your assessment outcome—whether it's a refund or an amount owing—so you can plan your finances accordingly.

- Secure Platform: The app uses advanced encryption to protect your personal and financial data, ensuring a safe and reliable eFiling experience.

- Return Status Tracking: After submission, monitor the status of your tax return in real time. View your Notice of Assessment (ITA34) and Statement of Account (ITSA) summaries directly within the app.

Frequently Asked Questions

Is the SARS Mobile eFiling app secure?

Yes, the app is fully secure. All data transmitted through the app is encrypted, safeguarding your sensitive information and ensuring compliance with national data protection standards.

Can I view my past tax returns on the app?

While full historical returns aren't available for editing, you can access summaries of your previous Notices of Assessment (ITA34) and Statements of Account (ITSA) for reference and record-keeping.

Can I use the app to file taxes for my business?

Currently, the SARS Mobile eFiling App is designed exclusively for individual taxpayers filing personal Income Tax Returns. Business tax submissions must still be handled via the desktop eFiling platform.

[ttpp]

[yyxx]

Final Thoughts

The SARS Mobile eFiling App is a major step forward in digital tax administration, offering a seamless, secure, and user-friendly experience for South African taxpayers. Whether you're an experienced eFiler or filing for the first time, the app empowers you to take control of your tax obligations with confidence and ease. With its intuitive design and powerful features, it’s no wonder more individuals are switching to mobile filing. Download the SARS Mobile eFiling App today and experience the future of tax management—simple, fast, and always within reach.